The legislature has provided in a favorable statute to promote cycling. This favorable statute foresees following benefits:

- 23cent / km can be deducted as commuting expense in case the deduction of actual business expenses is claimed;

- no benefit in kind needs to be charged (not even for purely private travel) provided that the bicycle is actually used for commuting fully or partly between home and work;

- The employer may also intervene in the commuting expenses by granting 23cent / km for the commuting route which is made by bicycle.

All benefits are also cumulative.

There are also benefits for employers: all costs related to the facilitation of a business bicycle entitle to an increased deduction of 120%. Not only the cost of the provided bicycle, but also the costs of showers and bike are envisaged.

But a bicycle is not to be considered as a vehicle with two wheels and pedals!

For tax purposes is a mountain bike or racing bike not (fully) equivalent to a ‘bicycle’

The 1st and 3rd benefits of the favorable statute remain applicable in case of sport bikes. However, a taxable benefit in kind is allocated to the employee beneficiary in cases where the ‘bike’ is provided by the employer. This taxable benefit in kind is considered as wage and therefore subject to withholding tax and social security.

According to the Minister of Finance, the 2nd benefit of the favorable statute is only applicable to city bikes and hybrid bikes (intermediate between a city bike and a mountain bike). The law does not make such distinction.

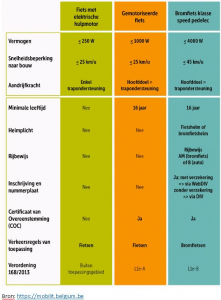

Further makes the minister of Finance also a distinction between “pedelecs” (electric bikes whose speed is limited to 25km/h) and “speed pedelecs” (electric bicycles speeding up to 45km/h).

“Pedelecs” are fiscally treated as bicycles and enjoy of all three possible tax benefits.

“Speed Pedelecs” are categorized by the Traffic Code as a “Class B motorcycle”. This qualification is extended to fiscal purposes with as a result that none of the advantages of the favorable statute for bicycles apply to speed pedelecs. The increased tax deduction of 120% for electric motorcycles is also not applicable because the speed pedelec is not purely electrical driven!!

“Speed Pedelecs” are categorized by the Traffic Code as a “Class B motorcycle”. This qualification is extended to fiscal purposes with as a result that none of the advantages of the favorable statute for bicycles apply to speed pedelecs. The increased tax deduction of 120% for electric motorcycles is also not applicable because the speed pedelec is not purely electrical driven!!

If an employer purchases or leases a “fast electric bike” and grants it to an employee as a “business cycle”, the employee will be taxed on the actual value of the advantage derived from the free use of the business cycle.

Remarkable is that the taxable benefit in kind for speed pedelecs might be higher than the minimum tax benefit of € 1.280,00 which applies to some company cars with low CO² emissions.