Tax deduction scheme starting from 01/01/2018 to 31/12/2019:

In the corporation tax: the deduction scheme as we know it today, is retained to 31/12/2019. The car will be classified according to its CO2 emission in a particular level of deduction.

Personal income tax: from 01/01/2018 the general deduction percentage of 75% won’t be applied anymore. Since the Government wants to encourage the self-employed in greening their vehicle fleet, the deduction will be comparable to the corporation tax but with a minimum deduction of 75%. You can get a higher deduction as a self-employed if the CO2-emission of your car is lower and consequently in a higher level deduction.

A distinction is, however, made from 01/01/2020:

– Vehicles purchased before 01/01/2018 remain of the above-mentioned deduction regulation as long as they are used (that is, if you used the car for 15 years, you’ll have right to the deduction arrangement for 15 years of at least 75%).

– Vehicles purchased after 01/01/2018 will be brought into line with the then-current arrangement in 01/01/2020 (further explained below).

Tax deduction scheme from 01/01/2020:

Starting from 01/01/2020, the deduction arrangement both in the corporate income tax as income tax will be adjusted. There will be a formula that will be applied to determine separately the deduction of each car.

The formula will look as follows:

120% – (0.5 x grams of CO2/km x coefficient)

The coefficient is:

1 for diesels and hybrid diesels

0.95 for gasoline and hybrid petrol

0.90 for natural gas with less than 12 tax HORSEPOWER

The maximum deduction will 100% and the minimum 50% deduction. However, if the CO2 emission is 200 grams or more per kilometer, the deduction is 40%.

For cars purchased before 01/01/2018 this scheme will not be applied on the personal income tax!!!

Special tax deduction for hybrid cars:

Starting from 01/01/2020 the so-called ‘ fake ‘ hybrid cars will be …….clearly we’re talking about hydride plug-in vehicles and not cars that might be considered as hybrid and obtain their electric power from, for example, the remactiviteit and charge while driving.

To determine the deduction percentage of ‘ fake ‘ hybrid cars, it is important to know the capacity of the battery. There are two possibilities:

– Capacity of at least 0.6 Kwh per 100 kg vehicle weight = CO2 from the hybrid version to handle.

– Capacity less than 0.6 Kwh per 100 kg vehicle weight = CO2 by the same type of vehicle with a classic fuel engine or if there is no comparable version with fuel engine is, the CO2 emissions of the hybrid version 2.5 times.

The obtained CO2-emission will be used to determine the percentage of deduction of the car expenses as for the calculation of the benefit in kind!

There is an important exception for the hybrid cars ordered before 01/01/2018. These cars continue to benefit the CO2-emission of the hybrid version, even after 01/01/2020.

It is not necessary that the vehicle has been delivered or registered for 01/01/2018. If you are considering the purchase before 01/01/2018, it is sufficient that you a signed order form or a signed leasing contract dated before 01/01/2018.

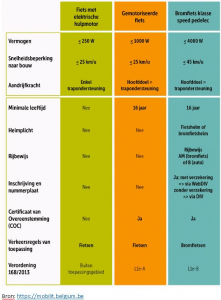

“Speed Pedelecs” are categorized by the Traffic Code as a “Class B motorcycle”. This qualification is extended to fiscal purposes with as a result that none of the advantages of the favorable statute for bicycles apply to speed pedelecs. The increased tax deduction of 120% for electric motorcycles is also not applicable because the speed pedelec is not purely electrical driven!!

“Speed Pedelecs” are categorized by the Traffic Code as a “Class B motorcycle”. This qualification is extended to fiscal purposes with as a result that none of the advantages of the favorable statute for bicycles apply to speed pedelecs. The increased tax deduction of 120% for electric motorcycles is also not applicable because the speed pedelec is not purely electrical driven!!