Source: powerpoint on the budget of the Prime Minister: Click here to view

Withholding tax on movable assets increases to 30%

The standard withholding tax rate increases from 27% to 30% by January 1, 2017.

This means, amongst others, that interests paid or credited by a company as of January 1, 2017 will be subject to a 30% withholding tax irrespective of whether the interest relates to a current account (R / C) or to a (long)term-loan and irrespective when the loan is contracted.

Historically increase standard withholding tax rate:

- since somewhere 80’s: 15%

- 1 Jan 2012: 21% (Di Rupo’s government)

- 1 Jan 2013: 25% (Di Rupo’s government)

- 1 Jan 2016: 27% (Michel’s government)

- 1 Jan 2017: 30% (Michel’s government)

However, the known exceptions are not affected (so-called. vvpr-bis-dividends, Letermebons, etc.). In such cases remains the withholding tax rate unchanged.

The 17% withholding tax rate is increased to 20% if the payment of dividends from the liquidation reserve occurs within the five-year waiting period. This also applies from January 1, 2017, but only on the growth of the liquidation reserves (which are built up for a taxable period associated with assessment year 2018 at the earliest). The increase does not apply to previously established reserves.

For interest on regulated savings accounts that exceed the exempt amount, remain both the rate of 15% and the exemption requirements unchanged for the time being.

Below an overview of the withholding tax tariffs with effect as from January 1, 2017:

- Withholding tax on regulated savings accounts (above the first exemption of interest of 1,880 euros) remains 15%

- Withholding tax on dividends from real estate investment trust or regulated real estate company remains 15%

- Withholding tax on term deposits rises from 27 to 30%

- Withholding tax on certificates of deposit rises from 27 to 30%

- Withholding tax on bonds rises from 27 to 30%

- Withholding tax to other government bonds rises from 27 to 30%

- Withholding tax on civil loans rises from 27 to 30%

- Withholding tax to shares rises from 27 to 30%

Stock exchange tax

The stock exchange tax is extended to Belgians acting through foreign brokers. Moreover, the current ceilings used to determine the stock exchange tax, are doubled.

This procedure replaces the speculation tax which will be abolished.

It is expected that in the course of 2017, the exchange of financial information between the tax authorities of the EU Member States will be done according to the Common Reporting Standard the Organisation for Economic Co-operation and Development has established. That exchange of information not only refers to interest (opposed to the former Savings Directive) but covers as well dividends and capital gains.

Stop back gate for non-taxable internal gains

A technique for withholding tax dodge (i.e. 30% as of 1/1/2017) is the transfer of shares of an operating company into a holding company, followed by:

Step 1: payment of dividends from the operating company to the holding company;

Step 2: a capital reduction in the holding company.

This way, funds from the operating company were paid out at 1.69% rate.

It will be dealt with this situation on the one hand by specific target audits and on the other hand by amending the legislation for the contributions made from 01.01.2017, namely by adjusting the definition of “paid-up capital”.

Company cars

Fuel and fuel cards

In addition to the existing taxation on company cars, a supplementary tax is implemented within the scope of the often associated fuel cards. This additional tax is payable by the employer.

In addition to the existing taxation on company cars, a supplementary tax is implemented within the scope of the often associated fuel cards. This additional tax is payable by the employer.

The above comes down to a change in the computation of the disallowed expenses on behalf of the company.

The benefit in kind – company car that is taxed on behalf of the beneficiary remains unchanged. The computation of the benefit is based on the CO² emission, fuel type, the date of inscription and the purchase price of the car.

The taxable benefit is determined regardless of whether the beneficiary does or does not receive a fuel card together with the company car.

Instead, the fiscal cost to the company will rise.

Disallowed expenses amounting to 17% will be increased to 40% if fuel costs “associated with the personal use” are fully or partly borne by the company.

Personal contribution

The actual taxable benefit in kind (BIK)- company car is reduced when the beneficiary pays a personal contribution.

The personal contribution also provides in a decrease of the disallowed expenses on behalf of the company given that the basis for calculation, i.e., the taxable benefit in kind, decreased or is annulated.

The computation base is now changed from the ‘taxable’ to the ‘in principle’ taxable benefit.

By disregarding the “personal contribution”, the company will continue to be taxed at a disallowed expense of 17% or 40% even in those cases where there is no actual taxable benefit on behalf of the beneficiary (due to personal contributions).

Both measures enter into force on January 1, 2017

Mobility Budget

By April 2017 a framework is to be worked out which will enable employees, whose salary package includes a company car (with or without fuel card) and in agreement with their employer, to replace the company car by:

– a mobility budget

– or in the form of additional net pay.

The option chosen is to be treated similarly as the company car regime from fiscal and para-fiscal point of view. The purpose is budget neutrality for all the individual employer, the individual employee and the government.

The modalities are still to be worked out.

How to calculate the BIK?

The taxable benefit for workers and managers rises in 2017 as the CO2-emission reference has been reduced resulting in an increase of the CO2 percentage used for the calculation of the BIK.

The taxable BIK – company is determined based on a lump-sum basis since January 1, 2012 in accordance with the following formula:

(Catalogue value * degressivity coefficient) * 6/7 * CO2 percentage

The Royal Decree of November 24, 2016 (B.S. December 3, 2016) fixed the reference CO2 emission for 2017:

| |

Diesel |

Benzine, LPG en aardgas |

| 2012 |

95 gr./km. |

115 gr./km. |

| 2013 |

95 gr./km. |

116 gr./km. |

| 2014 |

93 gr./km. |

112 gr./km. |

| 2015 |

91 gr./km. |

110 gr./km. |

| 2016 |

89 gr./km. |

107 gr./km. |

| 2017 |

87 gr./km. |

105 gr./km. |

Solidarity Contribution

The lump-sum solidarity contribution is calculated per vehicle the employer directly or indirectly provides to its workers (and this regardless possible employee’s contribution).

The charge takes place on monthly basis and is based on the CO² emission and fuel type of the relevant company car. The solidarity contribution will be computed as from January 1, 2017 as follows:

| Vehicles |

Formula |

| Petrol |

CO2 known: [(Y x 9 EUR) – 768] : 12 x 142,46/114,08 |

| CO2 unknown: [(182 x 9 EUR) – 768] : 12 x 142,46/114,08 = 90,54 |

| Diesel |

CO2 known: [(Y x 9 EUR) – 600] : 12 x 142,46/114,08 |

| CO2 unknown: [(165 x 9 EUR) – 600] : 12 x 142,46/114,08 = 92,10 |

| LPG |

[(Y x 9 EUR) – 990] : 12 x 142,46/114,08 |

| Electric |

26,01 EUR per month (= minimum contribution) |

Y is the CO2 emission in grams per kilometer, as stated in the certificate of conformity or in the compliance record of the vehicle, or in the database of the service for the registration of vehicles

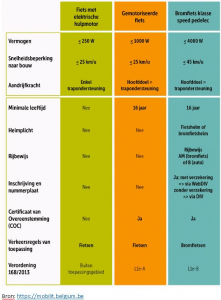

“Speed Pedelecs” are categorized by the Traffic Code as a “Class B motorcycle”. This qualification is extended to fiscal purposes with as a result that none of the advantages of the favorable statute for bicycles apply to speed pedelecs. The increased tax deduction of 120% for electric motorcycles is also not applicable because the speed pedelec is not purely electrical driven!!

“Speed Pedelecs” are categorized by the Traffic Code as a “Class B motorcycle”. This qualification is extended to fiscal purposes with as a result that none of the advantages of the favorable statute for bicycles apply to speed pedelecs. The increased tax deduction of 120% for electric motorcycles is also not applicable because the speed pedelec is not purely electrical driven!!

In addition to the existing taxation on company cars, a supplementary tax is implemented within the scope of the often associated fuel cards. This additional tax is payable by the employer.

In addition to the existing taxation on company cars, a supplementary tax is implemented within the scope of the often associated fuel cards. This additional tax is payable by the employer.