Individuals and companies who opted for the regime of quarterly VAT declarations, need to consider 5 instead of 12 payments a year going forward.

As from April 1, 2017 VAT taxpayers with a quarterly tax return will no longer pay monthly VAT advances. For the sake of clarity, for month taxpayers nothing changes.

The purpose of the abolition of VAT advance payments is to simplify the VAT procedure.

This simplification comes down to:

Currently quarter taxpayers must pay VAT advances for the first and second month of the quarter equal to 1/3 of the outcome due of the previous quarter. The payment related to the third month of the quarter is done based on the actual VAT return.

In other words, the arrangement for quarter taxpayers involved monthly payments whereby a settlement of the actual VAT balance took place on quarterly basis.

The simplification implies that the payment of VAT will coincide with the tax return obligation. If you are a quarter taxpayer, you will be paying the VAT on a quarterly basis as well.

This simplification does not mean that:

First, you will not pay less taxes. The VAT debt remains the same, you only pay it on quarterly basis instead of through monthly payments.

For some VAT taxpayers will the above result in a substantial payment each quarter. If applicable, put money aside throughout the quarter to fund the payment.

Second, not all advance payments are abolished. Both month as quarter taxpayers are now required to pay December’s advance. The advance payment arrangement for the fourth quarter will therefore apply to all VAT taxpayers.

Were you quarter taxpayer before 1.1.2017, then you still owe the advances for January and February. The simplification is namely foreseen to enter into force as of April 1, 2017.

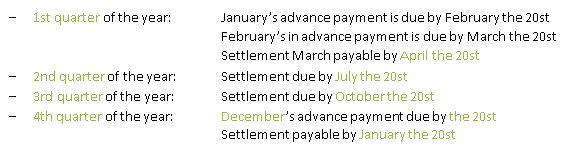

The 2017’s deadlines for VAT purposes are as follows:

Still questions, email us at info@odb.solutions