Bart Tommelein Flemish Minister for Energy wants to engage in energy-efficient homes in Belgium. Hereby he introduces the word “benoveren”, which stands for “better renovation”. Within this scope, the Flemish Energy Agency published the brochure “BENOveren: what, why and how” out.

“One who isolates his home in several places resulting in a decrease of the power consumption below a certain limit, receives a discount on the property tax. In some cases, the property tax is even avoid,” said the minister in the De Zevende Dag.

Concretely, it would meant that who can reduce their energy level up to E60 does not have to pay property tax for the next five years after renovation.

Even individuals who would not carry out the renovation works at once will be able to make optimal use of the tax rebate following the Minister. “The Flemish government provides in a possibility to borrow cheaply or for free during the next three years so that individuals can renovate”

Roof insulation: end of the tax reduction

The tax reduction for roof insulation will no longer be applicable from January 1, 2017.

A transitional measure is foreseen: who places an order and pays an advance before end of 2016 and actually pays the invoice at the latest on December 31, 2017, will still benefit of the tax reduction.

Insulation grants in 2017: what will change on Flemish level

The reform of the energy grants stood for a while on the program, but now it is a fact : as from 2017 these grants will differ significantly!

As from 2017 the energy subsidies in Flanders change. The Flemish government approved the plans of Annemie Turtelboom Energy Minister.

- Individual grants have been adjusted Premiums for roof and glass are decreased, incentives for heat pumps Roof insulation premiums are downsized from six to two

- The number of grants is reduced

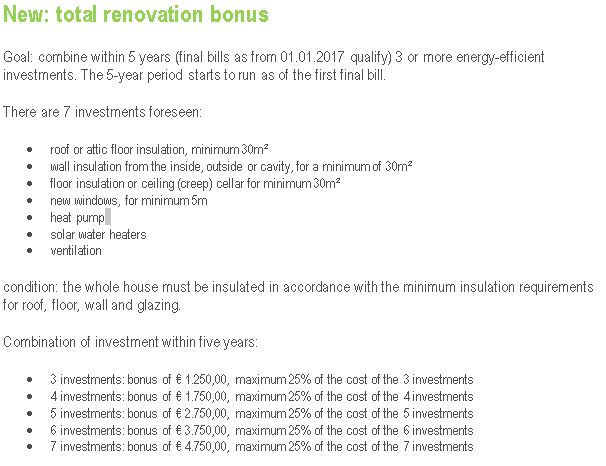

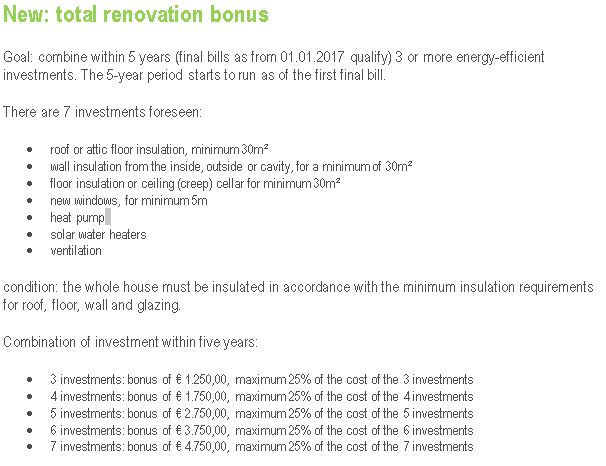

- A new premium to carry out throughout energy-efficient renovations is implemented

These changes will enter into force as of 01.01.2017 (date of final invoice). Until 31/12/2016 everything remains the same.